Spending in the Shadows

Spending in the Shadows

Nonspecific Funding in the FY 2018 New York State Enacted Budget

Download as a PDF: Spending in the Shadows – NYS FY18 Executive Budget

Executive Summary

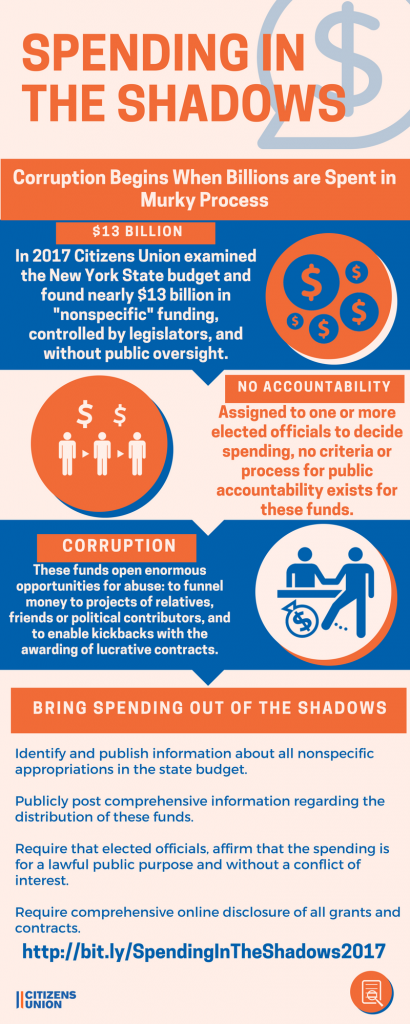

As part of its annual review of the New York State Budget and the spending of taxpayer dollars that takes place in the shadows, away from any real public scrutiny, Citizens Union has examined New York’s FY 2018 Enacted Budget and found that $1 billion in nonspecific lump sum funding “pots” were added to the FY 2018 Executive Budget proposed by the Governor, bringing the total amount of such funding that Citizens Union has identified to nearly $13 billion. Of the $1 billion that was added, over $600 million are nonspecific funds that designate one or more particular elected officials to make decisions on how the funds are to be spent, and nearly $400 million has been added to the State and Municipal Facilities Program, a nonspecific funding pot in which no particular official is granted spending authority, but which has been used to funnel monies to projects desired by the Governor and individual legislators.

Key Findings:

- The FY 2018 Enacted Budget contains $13 billion in nonspecific lump sum funds that Citizens Union could identify. These pots have very vague purposes assigned to them and lack specific criteria and strong accountability measures for decisions around their spending. $1 billion of this sum was not in the Executive Budget and was added to the Enacted Budget.

- Of the total nonspecific lump sum pots identified, nearly $3 billion is in approximately 65 lump sum pots subject to decisions of one or more particular elected officials, and nearly $10 billion is in approximately 40 different economic development and infrastructure pots listing no official with spending authority.

- A $2 billion multi-year affordable housing program, which had been a major nonspecific lump sum fund in the Executive Budget, has been re-categorized. The spending authorization of this lump sum pot had been subject to a Memorandum of Understanding (MOU) among the Governor, the Senate Majority Leader, and Assembly Speaker. Now that an agreement has been reached, this large pot has been divided into specifically dedicated funds, and the MOU provision has been deleted. Thus, a number of nonspecific funds subject to spending decisions by specific elected officials in the Enacted Budget is $1.6 billion less than in the Executive Budget, where the MOU provision had been included.

- These nonspecific lump sum pots do not include other sources of funds – including from public authorities, settlement proceeds and disaster relief monies – that can be used in open-ended, unaccountable ways.

- There is inadequate reporting as to how these funds are eventually spent, and no conflict of interest disclosures are required, even though elsewhere in the budget there are many specifically-delineated appropriations, spending criteria and reporting requirements.

There is no justification for the open-endedness and lack of transparency of so many funding sources. The Enacted Budget includes an enormous number of items that have substantially greater specificity and transparency, including specific funding sources, criteria for how the funding is to be spent, and reporting requirements, and there are a few instances where the budget explicitly provides that the reports are to be made public. The public is entitled to much more of this specificity in a budget of over $150 billion, much of which is drawn from the pockets of New York taxpayers.

Citizens Union recognizes the importance of flexible spending money to address the needs of the State, but New York State lawmakers should not be allowing this much spending without adequate oversight. Having many billions in nonspecific lump sum budget funds available, without specific criteria or accountability, opens enormous opportunities for abuse: to funnel money to projects of relatives, friends or major political contributors, to meet other personal needs of the official, and to enable kickbacks for the award of lucrative contracts. With corruption, an ongoing and serious concern in Albany, these enormous flows of money must be subject to greater oversight.

The open-ended nature of these funds is of particular concern in New York, where the immediate past leaders of both the Senate and Assembly were convicted of offenses relating to their leverage over state monies, nine aides and allies close to the Governor have been indicted for kickback schemes related to the Buffalo Billions program, and thirty-four legislators have lost their seats since the year 2000 due to corruption. Citizens Union continues to press for reforms that will tighten the way nonspecific lump sum appropriations are allocated and spent in New York. Measures that result in greater public disclosure of how the funds are spent and in which elected officials are involved in each spending decision, as well as the establishment of a conflict of interest guidelines, will help to give New Yorkers the confidence that their tax dollars are being appropriately and ethically spent.

We note that the Governor and both houses of the Legislature included different oversight provisions in their respective budget proposals, each designed to impose oversight on the other branch. None were included in the Enacted Budget.

Summary of Key Recommendations:

Citizens Union proposes the following recommendations to provide for public oversight and accountability:

- Identify upfront all nonspecific lump sum funds in the budget.

- Publicly post comprehensive information regarding the distribution of these nonspecific lump sum funds, including detailed purposes, criteria for spending decisions and who requested the spending.

- Require conflicts of interest disclosures of executive and legislative officials affirming that the contract or grant involved is for a lawful public purpose and the official has complied with financial disclosure requirements in the Public Officers Law.

- Require comprehensive and searchable online disclosure of all grants and contracts awarded under nonspecific lump sum funds, and information regarding the recipients, including key staff and, where relevant, their board of directors.

- Create public disclosure by aging the budget bills for three days (as is generally required for legislation) and identifying the legislative sponsor of nonspecific lump sum funds during the aging period.

I. Introduction

In March 2017, Citizens Union issued its latest in the series of Spending in the Shadows reports, addressing the Executive Budget for the fiscal year beginning April 1, 2018. These reports, begun in 2013, have examined budget appropriations of nonspecific lump sum “pots” through which the Governor and legislative leaders authorize spending large sums of taxpayer funds, with the actual spending decisions left to a later date and to one or more particular elected officials. There is only a vague purpose assigned to these appropriations, with no effective criteria for how the spending decisions are to be made, and no sufficient accountability for those decisions. Nearly $4.3 billion in such funds were set forth in the FY 2018 Executive Budget.

In the Spending in the Shadows report for the FY 2018 Executive Budget,[1] Citizens Union also examined funds that were to be used generally for economic development or infrastructure purposes which, though they did not identify specific elected officials who would be making spending decisions, also lacked a specific purpose, criteria, and means of accountability. Citizens Union identified $9.5 billion in these funds in the FY 2018 Executive Budget.

Over a week after the April 1 deadline, the Legislature passed the FY 2018 Enacted Budget. Citizens Union has examined the Enacted Budget to see if there were additional lump sum appropriations set forth that had not been included in the Executive Budget. We found that Governor Cuomo and the Legislature inserted over $600 million dollars in nonspecific lump-sum funds, not included in the FY 2018 Executive Budget, that may be specifically controlled by one or more elected officials. In addition, CU reviewed the economic development and infrastructure funds in the Enacted Budget and found that $385 million was added to the State and Municipal Facilities Program, which has been used to fund projects requested by the Governor and individual legislators.

These two sets of additions add up to over $1 billion in appropriations included in the budget, with little explanation as to how they are to be spent, no criteria for making spending decisions and no public accountability for the spending decisions.

The total amount of FY 2018 Enacted Budget appropriations in nonspecific funds subject to spending decisions by one or more specific elected officials is just under $3 billion, significantly less than the $4.3 billion in the FY 2018 Executive Budget. The reason for the lower figure is the resolution of the deadlock between the Governor and Legislature over the multi-year affordable housing program. The provision in the FY 2018 Executive Budget that $1.9 billion in affordable housing funds be subject to a memorandum of understanding (MOU) among the Governor, Senate Majority Leader [2] and Assembly Speaker has been replaced by a list of appropriations to fourteen specific housing programs. While questions remain as to how transparent the expenditures will be, we have removed these funds from our list of nonspecific funds.

The inclusion in the FY 2018 Enacted Budget of the $385 million State and Municipal Facilities Program appropriation means that nearly $10 billion is budgeted for various economic development and infrastructure funds that, although they are not explicitly subject to a specific elected official’s decision, also lack criteria or accountability, and thus raise similar concerns.

Join Citizens Union

Citizens Union is an independent, nonpartisan, civic organization working to promote good government and advance political reform in the city and state of New York. We rely upon financial support from our members to carry out our work. Join Citizens Union and join a principled and pragmatic effort to make democracy work for all New Yorkers.

II. Changes between the FY 2018 Executive and Enacted Budgets

- Funds under control of specific elected officials

- Funds Added in the FY 2018 Enacted Budget

The FY 2018 Enacted Budget includes $625 million in both new appropriations and reappropriations to the Executive Budget that are nonspecific lump sum appropriations subject to later decisions by specific elected officials. A chart listing each item can be found in Appendix A.

| Budget Bill | Amount (in thousands) | Number of Funding Pots[3] |

| S2000-D/A3000-D (State Operations) | $152,327,000 | 2 |

| S2003-D/A3003-D (Aid to Localities) | $247,371,500 | 13 |

| S2004-D/A3004-D (Capital Projects) | $204,927,000 | 3 |

| S2009-C/A3009-C (Revenue) | $20,000,000 | 1 |

| Total | $624,625,500 | 19 |

Of the appropriations inserted into the Enacted Budget, $216.7 million were new appropriations and $407.9 million were reappropriations, appropriations that had been included in prior Enacted Budgets but were not included in the Governor’s FY 2018 Executive Budget. This is not an unusual byproduct of the budget process, as the Governor did not include certain reappropriations in the budget he submitted and left it to the Senate or Assembly to bargain to include those provisions as part of the negotiating give-and-take.

The major new appropriations are:

-

-

- $59 million in the State Operations budget, under the Office of Kindergarten through Twelfth Grade Education Program,[4] listed as “additional grants to certain school districts, public libraries and not for profit institutions.” These funds are to be spent pursuant to a plan approved by the Senate Majority Leader and adopted by the Senate. The Assembly received control over only $590,000 in such funds. In addition to the new appropriations, $71 million in reappropriations were inserted in the budget subject to Senate control and $23 million in reappropriations were inserted subject to Assembly control.

- $130 million in the Capital Projects budget for transportation infrastructure and facilities of regional and community importance. The spending is to be done pursuant to plans provided by the Assembly Speaker and the Senate Majority Leader. The vague language is as follows:Transportation infrastructure and facilities of regional and community importance to be accelerated in a manner consistent with the Department [of Transportation]’s planning and engineering processes and pursuant to plans provided by the speaker of the assembly and the temporary president and majority leader of the senate and posted to the Department’s public-facing website. [5]

Note: the public posting of these plans is unusual in the budget and should be commended; we do not know whether the plans will provide project-specific information or information as to what spending is made on which projects. Such specificity is required in a number of other budget items, though there is no requirement that the reports attendant to those items be publicly posted.

-

- $20 million in the Revenue bill, authorizing the Comptroller to transfer $20 million to a community projects fund, with spending requests to come from one or both houses of the Legislature: “The director of the budget shall (a) have received a request in writing from one or both houses of the legislature, and (b) notify both houses of the legislature in writing prior to initiating transfers pursuant to this authorization.”[6]

The major reappropriations, in addition to the education reappropriations noted in the first bullet above, that are newly included in the Enacted Budget are:

- $72 million in the Capital Projects budget, under the CUNY section, for alterations and improvements to be undertaken in consultation with the Senate Majority Leader.[7] These funds were originally appropriated in 2005.

- $74 million in the Aid to Localities budget, originally a 2009 appropriation, under “All State Departments, Maintenance Undistributed”, for services, expenses, grants or contracts with certain nonprofits, universities, colleges, school districts, corporations or municipalities, pursuant to section 99-d of the state finance law.[8] These funds are to be made available pursuant to plans that shall include but not be limited to an itemized list of grantees, with amounts to be received by each, submitted by the Secretary of the Senate Finance Committee by January 15, 2010 and subject to the approval of the state’s Budget Director.[9] There is a similar item, subject to an itemized list submitted by the Secretary of the Assembly Ways and Means Committee, for $9,375,000. In addition, there are reappropriations for the same purpose, originally appropriated in fiscal years 2003-2006, totaling $149 million that are subject to an MOU among the Budget Director, the Secretary of the Senate Finance Committee and the Secretary of the Assembly Ways and Means Committee.

There are examples throughout the budget documents themselves of appropriations that are targeted to more specific purposes and that have criteria for spending. For example, much of the hundred pages before the $130 million transportation listing in the Capital Projects budget include specific appropriations for SUNY institutions. As an example, here are the new appropriations for Erie Community College:

| State Share | |

| Building Infrastructure Improvements/Renovations | $1,000,000 |

| College-wide Site Work | $650,000 |

| Code Compliance Upgrades | $375,000 |

| Roof Replacement and Water-proofing | $1,000,000 |

| Mechanical, Electrical and Plumbing Improvements | $500,000[10] |

There are many listings of appropriations to a specific agency, community or nonprofit organization demonstrating that the state provides specificity in some area of budget appropriations and not others. Good examples of this can be found in appropriations in the Division of Criminal Justice Services, Department of Economic Development and Department of Mental Hygiene sections of the Aid to Localities budget.[11] In addition, there are many examples of appropriations for specific purposes, with detailed criteria as to how the funds are to be spent. For example, in the State Operations budget, many of the appropriations under the Department of Education added in the FY 2018 Enacted Budget have detailed criteria. [12] The $35 million appropriation for empire state after-school grants provide for (i) development of a plan, (ii) allocation formulas, (iii) criteria, (iv) a requirement that school districts adopt indicators of quality, and (v) that a competitive process be used. [13] Other appropriations specify that a report on the spending be provided; for example, under the Office of Children and Family Services funding provided by local probation departments for post-placement care of youth, funded agencies must “submit information regarding outcome based measures that demonstrate quality of services provided and program effectiveness…”[14] Other appropriations require that spending be made through a competitive process.[15]

There are also many appropriations in which the Budget Director or a commissioner is required to report on spending plans for, or the spending of, certain budget lines to the chairs of the Assembly Ways and Means Committee and the Senate Finance Committee, or to other legislative committees.[16]None of the appropriations we have discussed in this report have that provision, and it is conspicuous that there is no instruction in the reporting language that any information from these reports be publicly posted, except for the $130 million transportation appropriation, which calls for posting of spending plans. The Governor and legislative leaders know how to require specific reporting. As one example, grantees in a pilot program for expanding access to child care subsidies for working families in Erie County must report on the number of children eligible for the program, their ages, the number of families served who receive family assistance, the factors the parents considered when searching for child care, the factors that barred the families access to child care assistance prior to this program, and details on how the parents are using the subsidy.[17]

We note that the Governor included in the FY 2018 Executive Budget the requirement that a legislator seeking to allocate funds to a specific project make disclosures regarding the project and potential conflicts. The Senate and Assembly, in their one-house budget bills, did not include that requirement but set out their own provisions that would have provided more accountability for economic development spending. Neither of these approaches was included in the FY 2018 Enacted Budget. Aside from the public posting of the plans involved in the $130 million transportation spending item noted above, the only public accountability in the Enacted Budget remotely of this kind that we were able to identify was in Part UUU of the Revenue bill (S2009-C/A3009-C), which requires the Department of Economic Development to prepare an “annual comprehensive economic development report,” to be posted on the department’s website. However, this report provides only aggregate information, not the kind of project-by-project information on spending and outcomes, or potential conflicts of interest, to which the public is entitled.

Deletion of MOU Provision in the Affordable Housing Appropriations

While $625 million in nonspecific lump sum appropriations were added to the budget, the total of appropriations and reappropriations in our tabulation is $1.3 billion less than the total in the Executive Budget. Two small reappropriations, totaling $1,742,000, were in the Executive Budget but do not remain as nonspecific appropriations in the Enacted Budget (see Appendix A). However, the main reason for the reduction is that the MOU provision in the reappropriations for the multi-year affordable housing plan, included in the FY 2017 Enacted Budget, was removed. The Governor and legislative leaders agreed to add $541,525,000 to the housing program, for a total of approximately $2.5 billion, and to divide the funding into fourteen categories.[18] The largest amount, $950 million, is to be used for 6,000 or more affordable housing units over the next five years, as determined by a competitive selection process. The remaining funding categories, including funding specifically targeted to senior, low-income, moderate income, Mitchell-Lama and other categories of housing, do not include a competitive selection process.

The Commissioner of Housing Preservation and Development is to prepare an annual report to the Budget Director, Assembly Speaker and Senate Majority Leader summarizing the activities undertaken pursuant to the affordable housing program, describing each project, its budget, the amount of subsidy, number of units, date of occupancy and other data.

Although it is not clear how the funds, particularly the $1.5 billion not subject to a competitive process, will be spent and whether the Commissioner’s reports will be publicly available (there is no provision for the public posting of the reports), we have removed the affordable housing plan from our totals, because the MOU provision was removed and additional specificity was provided in the budget.

-

- Total Nonspecific Lump Sum Funding in FY 2018 Enacted Budget

The FY 2018 Enacted Budget contains just under $3 billion in nonspecific lump sum pots subject to spending decisions by one or more specific elected officials. The breakdown of this spending among the budget bills is as follows:

| Budget | New Appropriations | Reappropriations | Total |

| State Operations | $59,169,000 | $93,158,000 | $152,327,000 |

| Aid to Localities | $7,555,000 | $345,298,734 | $352,853,734 |

| Capital Projects | $240,000,000 | $2,198,045,000 | $2,438,045,000 |

| Revenue | $20,000,000 | $20,000,000 | |

| Total | $326,724,000 | $2,636,501,734 | $2,963,225,734 |

This total is $1.8 billion less than in the FY 2017 Enacted Budget and $1.3 billion less than in the FY 2018 Executive Budget, largely as a result of the removal of the MOU provision from the affordable housing program appropriations. The breakdown of the various mechanisms identified in the budget as to how the spending decisions are to be made is as follows:

- Involving Legislative Leaders

| i. MOU between executive and legislative leaders | $950,883,000 | |

| ii. MOU (mechanism not specified but involves the Legislature) | $269,095,000 | |

| iii. Approval by Budget Director and Majority Leader, plus Senate resolution | $263,392,500 | |

| iv. Approval by Budget Director and Assembly Speaker, plus Assembly resolution | $23,162,000 | |

| v. Consultation with Senate Majority Leader | $174,150,000 | |

| vi. MOU between Transportation Commissioner and Senate Task Force | $7,218,000 | |

| vii. Consultation with Assembly Speaker | $12,736,000 | |

| viii. Consultation with Chair, Assembly Ways and Means Committee | $1,121,000 | |

| ix. Consultation with legislative leaders | $10,000,000 | |

| x. Senate Majority Labor Initiative | $515,000 | |

| xi. List of projects submitted by Senate | $74,375,000 | |

| xii. List of projects submitted by Assembly | $9,375,000 | |

| xiii. Plans provided by Assembly Speaker and Senate Majority Leader | $130,000,000 | |

| xiv. Requests for spending from one or both houses of the Legislature | $20,000,000 | |

| B. Pursuant to plan developed by Attorney General | $81,500,234 | |

| C. Pursuant to plan developed by Governor and SUNY or CUNY Chancellor | $910,703,000 | |

| D. Funds to flow to organizations chosen by mayors of certain cities and Bronx Borough President | $25,000,000 | |

| Total | $ 2,963,225,734 |

B. Economic Development and Infrastructure Funds

Citizens Union’s Spending in the Shadows report on the FY 2018 Executive Budget identified $9.5 billion in appropriations in approximately 40 nonspecific budget items addressing economic development and infrastructure. Those items also are included in the Enacted Budget.[19] In addition, $385 million was added to the State and Municipal Facilities Program in the Enacted Budget. When added to the $1.25 billion reappropriated to the fund from prior years, over $1.6 billion is available for spending under this fund. In our prior reports, we have noted that spending from this fund has been driven to a substantial extent by the Governor and legislators.[20] The Dormitory Authority of the State of New York, which administers the program, posts awards, including a brief purpose and whether the sponsor is the Senate, Assembly or Executive (no names are provided),[21] and indeed Project Information Forms requesting funding are submitted by legislators (many such forms, at least for older requests, have been posted on the Senate and Assembly websites,[22] though there is no information on the websites as to whether the requests have been granted, and how the money was used). However, there is no public accounting of how decisions are made regarding the spending of the State and Municipal Facilities Program, or who is making the spending decisions.

With the addition of this $385 million appropriation, nearly $10 million has been appropriated or reappropriated to nonspecific economic development and infrastructure funds. A list of these funds can be found in Appendix B. Although the appropriations do not identify any elected official as responsible for spending decisions from these funds, they have the same opacity as the nonspecific funds discussed in the prior section, with no criteria or accountability.

It should also be noted that there has been a significant change in the $150 million appropriations for the Life Science Laboratory Public Health Initiative in the Capitol District, in the Capital Projects budget.[23] The Enacted Budget now includes a requirement that the spending be pursuant to a plan, which shall be reviewed and approved by the NYS Public Authorities Control Board (PACB). This board is composed of representatives of the Governor, the Assembly Speaker, the Senate Majority Leader, and the minority leaders in both houses. The legislative representatives have tremendous leverage on PACB decisions, so this fund now might well be viewed as one in which legislative leaders can exercise discretion, again with no criteria or accountability.

III. Total Nonspecific Lump Sum Appropriations In FY 2018 Enacted Budget

The appropriations and reappropriations of nonspecific funds subject to control of elected officials and in the various economic development and infrastructure funds total nearly $13 billion:

| Appropriations under Control of Officials | $2,963,225,734 |

| Economic Development and Infrastructure Funds | $9,903,836,000 |

| Total | $12,867,061,734 |

IV. Other FY 2018 Funds Susceptible to Influence by Elected Officials

In prior Spending in the Shadows reports, Citizens Union had identified other categories of funds that are available for use without the normal oversight that would attend itemized, specific budget appropriations. These are described in fuller detail in our report on the FY 2018 Executive Budget. They include:

Public Authorities

Public authorities operate with few of the limits imposed on state agencies, and over the last several decade’s uses of authorities and their fiscal power have increased greatly. Their boards and board chairs are largely appointed by the Governor. According to the State Comptroller, in their last reporting periods, the 324 identified state level authorities and subsidiaries generated $44.8 billion and had $42.9 billion in expenditures, resulting in a net of almost $2 billion.[24]

A number of authorities, such as the New York Power Authority (NYPA), The New York State Energy Research and Development Authority (NYSERDA) and the Thruway Authority have accumulated sizeable account balances, which can be used for a wide variety of purposes, some of which stretch the bounds of what the authority was created to do. As one example, the operation of New York’s canals was transferred from the Thruway Authority to the NYPA even though the connection between canals and the mission of the NYPA is tenuous at best.

Settlement Proceeds

As noted more fully in our report on the FY 2018 Executive Budget, New York has received $9.2 billion in monetary settlements with financial institutions and Volkswagen.[25] According to the Division of the Budget, nearly $7 billion remain from those settlements. The projected balance at the end of FY 2017 was $4.4 billion and $1.1 billion has not been allocated. However, even the amounts that have been allocated are subject to being used for other purposes under the State Finance Law, so there is no assurance as to how those funds will be spent and how public officials can be held accountable for that spending.

Public Safety and Emergency Response

The FY 2018 State Operations Budget includes the $8 billion reappropriation to address the impact of Superstorm Sandy and to mitigate the impact of future natural or man-made disasters. These payments can go to local governments, businesses, and individuals, among other recipients. Although most of the money comes from federal sources, there are no criteria for making spending decisions and the reporting provision, as noted in our earlier reports, is unsatisfactory.

V. Why this Matters

Citizens Union has identified nearly $3 billion in nonspecific funding subject to decisions by particular elected officials, nearly $10 billion in economic development and infrastructure funds, and billions more in other categories that have similar features: vague purposes, no criteria and no public accountability. This is an enormous amount of money to allow elected officials to manipulate outside and away from the public view. The funds provide a vast opportunity for officials to favor and enrich supporters, benefit family members and generate large pay-to-play campaign contributions. These are not speculative outcomes, as the prosecutions of the immediate past Assembly Speaker Sheldon Silver, the immediate past Senate Majority Leader Dean Skelos and a number of aides to Governor Cuomo feature all of these results.

We recognize the importance of flexible spending money to address the needs of the State, but New York State lawmakers should not be allowing this much spending without adequate oversight. Citizens Union is not opposed to what nonspecific lump sum appropriations are being spent on, merely the lack of transparency and accountability over how these enormous sums are being spent. Since the year 2000, 34 members of the Legislature have had to leave office due to corruption. The culture of corruption is fed by officials’ easy access to billions of dollars. Indeed, as described above, the language accompanying most of the $1 billion added to the FY 2018 Enacted Budget shows that these appropriations and reappropriations are blatant grabs for public funds to be doled out as the Governor, Senate and Assembly leaders choose. The funding purposes are beyond vague, and there is absolutely no accountability mechanism put in place.

It is not surprising that 93% of New Yorkers surveyed in a 2016 Siena poll said corruption is a serious problem in New York.[26] The Governor and Legislature can and should take major steps to provide more accountability as to how these vast sums are allocated and spent.

VI. Summary of Key Findings

The key findings of the report are as follows:

- The FY 2018 Enacted Budget contains $13 billion in nonspecific lump sum funds that Citizens Union has identified. These pots have very vague purposes assigned to them and lack spending criteria and strong accountability with regard to their spending decisions. $1 billion of this sum was not in the Executive Budget and was added to the Enacted Budget.

- Of the total nonspecific lump sum pots identified, nearly $3 billion is in approximately 65 lump sum pots subject to decisions of one or more particular elected officials, and nearly $10 billion is in approximately 40 different economic development and infrastructure pots listing no official with spending authority.

- A $2 billion multi-year affordable housing program, which had been a major nonspecific lump sum fund in the Executive Budget, has been re-categorized. The spending authorization of this lump sum pot had been subject to a Memorandum of Understanding (MOU) among the Governor, the Senate Majority Leader an, Assembly Speaker. Now that an agreement has been reached, this large pot has been divided into specific dedicated funds, and the MOU provision has been deleted. Thus, the amount of nonspecific funds subject to spending decisions by specific elected officials in the Enacted Budget is $1.6 billion less than in the Executive Budget, where the MOU provision had been included.

- This does not include other sources of funds, including from public authorities, settlement proceeds and disaster relief monies that can be used in open-ended, unaccountable ways.

- There is inadequate reporting as to how these funds are eventually spent, and no conflict of interest disclosures are required, even though elsewhere in the budget there are many specifically-delineated appropriations, spending criteria and reporting requirements.

VII. Recommendations

Citizens Union strongly recommends that Governor Cuomo and the Legislature take the following actions:

- Identify all nonspecific lump sum appropriations upfront in the state budget, both those identified with an elected official and those that are not. This can be done in a schedule accompanying the budget bills.

- Publicly post comprehensive information regarding the distribution of these nonspecific lump sum funds, including detailed purposes, criteria for spending decisions and who requested the spending. This would include criteria established by agencies.[27] Such a listing should indicate specific purposes, any geographical or other eligibility criteria, and whether the funds will be allocated according to a competitive process or some other means.

- Amend the State Finance Law to require that elected officials, both executive and legislative, who seek to make awards from nonspecific lump sum appropriations or reappropriations affirm that the contract or grant is for a lawful public purpose; that the elected official has not and will not receive any financial benefit; that there are no conflicts of interest; and that the elected official is in compliance with all financial disclosure requirements in the Public Officers Law.

- Require comprehensive online disclosure of all grants and contracts awarded under nonspecific lump sum appropriations and reappropriations. Disclosure should be in a user-friendly, machine-readable, searchable format permitting independent analysis and should include all MOUs, plans, resolutions and other agreements; funds distributed and the amount of funds that remain; and the identity of recipients (including information such as key staff and, where relevant, their board of directors) and the elected official who sponsored the spending.

- Create public disclosure by aging the budget bills for three days (as is generally required for legislation) and identifying the legislative sponsor of nonspecific lump sum funds during the aging period.

Footnotes

[2] Different budget appropriations and reappropriations refer to the Temporary President and Majority Leader of the Senate. The same individual holds both titles and this report will use the title “Majority Leader”.

[3] Some of these pots are new and some added to funds appropriated for the same purpose in previous years.

[4] S.2000-D/A.2000-D (FY 2018 State Operations budget) at 743, 761.

[5] S.2004-D/A.3004-D (FY 2018 Capital Projects budget) at 616.

[6] S.2009-C/A.3009-C (FY 2018 Revenue bill) at 264.

[7] S.2004-D/A.3004-D at 48.

[8] State Finance Law section 99-d sets up a City University stabilization fund and the funds are to be supposedly for use for CUNY.

[9] S.2003-D/A.3003-D (FY 2018 Aid to Localities budget) at 933.

[10] S.2004-D/A.3004-D at 513.

[11] See, e.g., S.2003-D/A.3003-D at 76-86. 136-138 and 763-4.

[12] S.2000-D/A.3000-D at 715 et seq.

[13] Id. at 745.

[14] S.2003-D/A.3003-D, at 242.

[15] See, e.g., S.2003-D/A.3003-D. at 189 (re: out-of-school child care); S.2004-D/A.3004-D at 342 (re: housing).

[16] See, e.g., S.2000-D/A.3000-D at 55 (re: CUNY) and 110-1 (re: education); S.2003-D/A.3003-D at 191-2 (re: day care), 246 (re: young adult supportive housing) and 598-9 (re: medicaid).

[17] S.2003-D/A.3003-D at 197.

[18] See S.2004-D/A.3004-D at 342 et seq.

[19] This list does not include funds appropriated for a specific economic development or infrastructure purpose, such as the Javits Center renovation, as the list focuses on funds which appear to be provided for multiple purposes under a particular theme. The list also may not include all funds that can be used for economic development or infrastructure purposes.

[20] See, e.g., Vielkind, Jimmy, Despite outcry, discretionary funds grow in state budget. Politico New York, April 4, 2016 ; Weaver, Teri, NY lawmakers, Cuomo, borrow $1B for pet projects, like a Syracuse aviation museum. Syracuse.com, November 15 (updated November 16), 2015. ; Bragg, Chris, Budget adds $385 million in pork, but no transparency. TimesUnion.com, April 10, 2017.

[21] https://dasny.org/Libraries/2017_Grants/SAM_Posting_as_of_5-22-17.pdf

[22] See https://www.scribd.com/document/283748450/New-York-State-and-Municipal-Facilities-Program-Project-Nomination; http://www.nyassembly.gov/statemunicipal/

[23] S.2004-D/A.3004-D at 828.

[24] NYS Office of the Comptroller, Public Authorities by the Numbers (January 2017) at 1,8.

[25] NYS Division of the Budget, FY 2017 Financial Plan Mid-Year Update (Nov. 2016 at 28).

[26] https://www.siena.edu/news-events/article/passing-new-laws-to-address-corruption-in-state-government-is-voters-top-en

[27] For an example of a requirement that an agency report on how awards that are granted meet objective criteria established by a commissioner, see the terms of the reappropriation to the Department of Mental Hygiene, Office of Alcoholism and Substance Abuse Services to support efforts regarding substance abuse treatment and recovery, S.2003-D/A.3003-D (Aid to Localities Budget) at 747-8.

Appendix: Spending in Shadows.xlsx